Myths About Life Insurance Continued…

Myth # 4 – You have to do lots of medical tests to get covered

Some life insurance products sold through financial advisers require some medical tests before you get covered, but it may be as simple as one blood test and a GP examination.

- If you have an existing medical condition, you may be asked to provide extra information about your condition and insurers will generally write to your doctor for a report rather than require tests

- You generally won’t be covered for pre-existing conditions, so it’s important to establish upfront what those pre-existing conditions are. It’s important to answer all questions accurately upfront so any pre-existing conditions can be reviewed by your insurer for any impacts to your cover or ability to obtain cover.

- That way you know exactly what is and isn’t covered under your policy.

Myth # 5 – Level premiums don’t go up

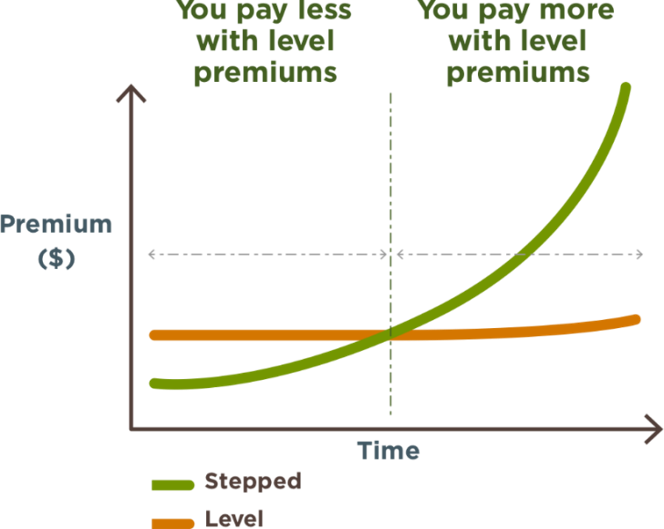

‘Level premiums’ are designed to save you money over the long term by eliminating the impact of age-based premium increases.

Level premiums are calculated based on your age when the cover started, not at each anniversary, which means premiums are generally averaged out over a number of years. This means your cover is more expensive than ‘stepped premiums’ at the beginning of your policy, but generally gets cheaper (relative to stepped premiums) as your policy continues.

It’s important to note that at policy anniversary the premium may still increase (even with level premiums), because age is just one factor that determines your premium. Other factors that impact premium (such as claims trends in Australian population) can result in a repricing of your insurance cover.

When insurers reprice stepped or level premiums, they don’t do it for an individual policy within a specific group unless they do it for every policy in that group.

Many life insurers in Australia have repriced level premiums in the past, so it’s important to talk to your financial adviser or your life insurer to understand your policy as well as any repricing activity that’s recently occurred, so you can make an informed decision.

The above graph is for illustrative purposes only. This graph illustrates age-based premium increases for stepped against level for all covers. This premium comparison has been calculated, assuming all other factors affecting the premiums are excluded.

Both stepped and level premiums can increase due to factors other than age.

Myth # 6 – I’ll be stuck paying for cover I don’t need

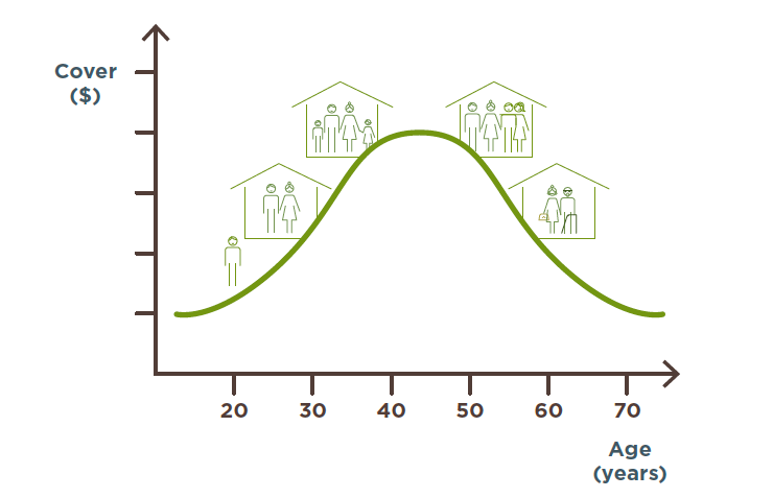

Life insurance is designed to change as your life changes, as your cover needs can vary significantly over your lifetime.

An example may be when taking out life insurance when getting married. You may want to increase your cover if you have children or increase your mortgage. But similarly you may want to reduce your cover if your children have grown up or you’ve paid down your debts.

Your financial adviser can help you work out how much cover you need at any given time, to make sure you’re not paying for any cover you don’t need.