Don’t Panic – Tax Treatment Of Your Super Could Change – Transition to Retirement

What is it?

People who have reached their preservation age and are still working are able to access their superannuation and start a transition to retirement (TTR) strategy. Your preservation age is the earliest time at which you can start to access your superannuation and currently ranges between 55 and 60, depending on your date of birth.

How it works

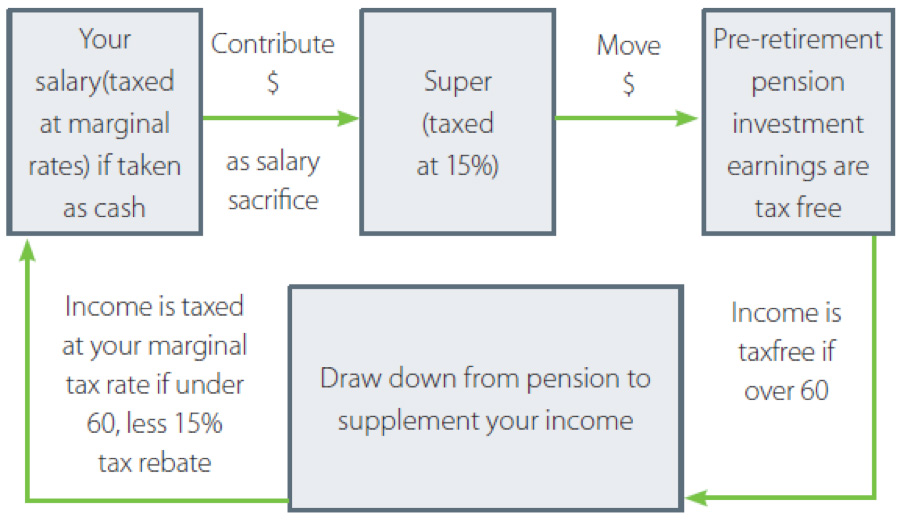

A portion of your existing superannuation account is converted into an income stream (a TTR pension account) whilst you’re still working. The pension account pays you regular payments. You can then salary sacrifice part of your salary and wages back into your superannuation account and still have the same amount of money to cover your cost of living. The diagram below gives you an idea as to how your money moves when using this strategy:

As always, there are a number of rules and limitations, and the amount of benefit in this strategy depends on a number of factors. However, it does become more attractive once you are over 60 years of age and the income from the pre-retirement pension is tax free.

WARNING – The Government is constantly reviewing the superannuation system and looking for ways to reduce the tax benefits associated with it. As a result, what are tax free benefits today could become taxable tomorrow (i.e. after this year’s budget is handed down).

Ask us to run some calculations for you the next time you come in for a review so you’re fully aware of how this strategy works.